Sovereign Gold Bond Latest Rates 2026

Sovereign Gold Bond Latest Rates & Returns — 2026 Update

Sovereign Gold Bonds (SGBs) is said to have delivered exceptional returns for long term investors and remain to be the best goverment backed ways to invest in gold without physical metal.

Latest Redemption Prices (2025–26)

SGB 2017–18 Series XIV (Redeemed Jan 1, 2026):

-

Final redemption price is said to have fixed at ₹13,486 per gram based on RBI valuation.

-

This represents a record return of about 367% over the 8-year period vs issue price of ₹2,890 per gram.

-

Investors have also earned 2.5% interest per year on the original value, bringing the total effective return close to ~387%.

-

Capital gains are at maturity are tax-free for individual investors.

Key Features of Sovereign Gold Bonds

✔ Interest Income: 2.5% per annum paid semi-annually (on initial issue price).

✔ Tax Benefits:

-

Capital gains are at maturity are exempt from tax for individuals.

-

Interest is said to be taxable as per the income tax slab.

✔ Safe & Government-Backed: Issued by the Reserve Bank of India (RBI) on behalf of the Government of India.

✔ No Making/Storage Costs: Unlike physical gold, there are no making charges or storage hassles. -

How Redemption Price Is Determined

The final redemption price of SGBs is based on the simple average of closing price of 999 gold purity published by the India Bullion and Jewellers Association Ltd (IBJA) for the previous three business days before maturity.

Important Notes for 2026

-

Many older SGB tranches issued between 2017–2021 have matured or reached premature redemption windows with high returns.

-

There are no new SGB issues is said to have been confirmed since early 2025 as the government is said to have revaluates the scheme due to borrowing costs.

- Investors still can able to buy SGBs on the secondary market through prices may trade at premium/discounts.

-

Quick Summary

| Feature | SGB Investment |

|---|---|

| Latest Redeemed Price (2026) | ~₹13,486 per gm (SGB 2017–18 Series XIV) |

| Annual Interest | 2.5% p.a. |

| Capital Gains Tax | Tax-free at maturity (individuals) |

| Government Guarantee | Yes (RBI/GOI) |

| No Storage or Making Costs | Yes |

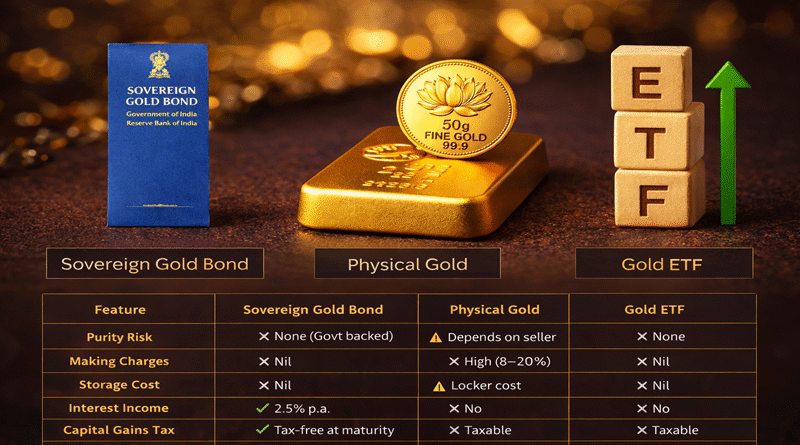

Sovereign Gold Bond vs Physical Gold vs Gold ETF (2026 Comparison)

SGB vs Physical Gold vs Gold ETF – Which Is Better in 2026?

| Feature | Sovereign Gold Bond (SGB) | Physical Gold | Gold ETF |

|---|---|---|---|

| Purity Risk | ❌ None (Govt backed) | ⚠ Depends on seller | ❌ None |

| Making Charges | ❌ Nil | ❌ High (8–20%) | ❌ Nil |

| Storage Cost | ❌ Nil | ⚠ Locker cost | ❌ Nil |

| Interest Income | ✅ 2.5% p.a. | ❌ No | ❌ No |

| Capital Gains Tax | ✅ Tax-free at maturity | ❌ Taxable | ❌ Taxable |

| Liquidity | Medium | High | Very High |

| Best For | Long-term investors | Jewellery buyers | Traders |

Winner for long-term investment: ✅ Sovereign Gold Bonds

Winner for liquidity: ✅ Gold ETFs